how could a worksheet help in preparing financial statements

The Adjustment Process

23 Prepare Financial Statements Using the Adjusted Trial run Balance

One time you have prepared the adjusted trial run balance, you are ready to prepare the financial statements. Preparing business statements is the seventh step in the account motorcycle. Remember that we have four fiscal statements to prepare: an income statement, a statement of retained earnings, a proportionality sheet, and the command of cash flows. These financial statements were introduced in Launching to Financial Statements and Program line of Cash Flows dedicates in-depth discourse to that statement.

To prepare the financial statements, a troupe testament take the adjusted trial proportion for account information. From this information, the company will begin constructing for each one of the statements, source with the income statement. Income statements volition include all revenue and expense accounts. The statement of retained earnings will let in beginning retained earnings, any net income (loss) (found on the profit-and-loss statement), and dividends. The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock.

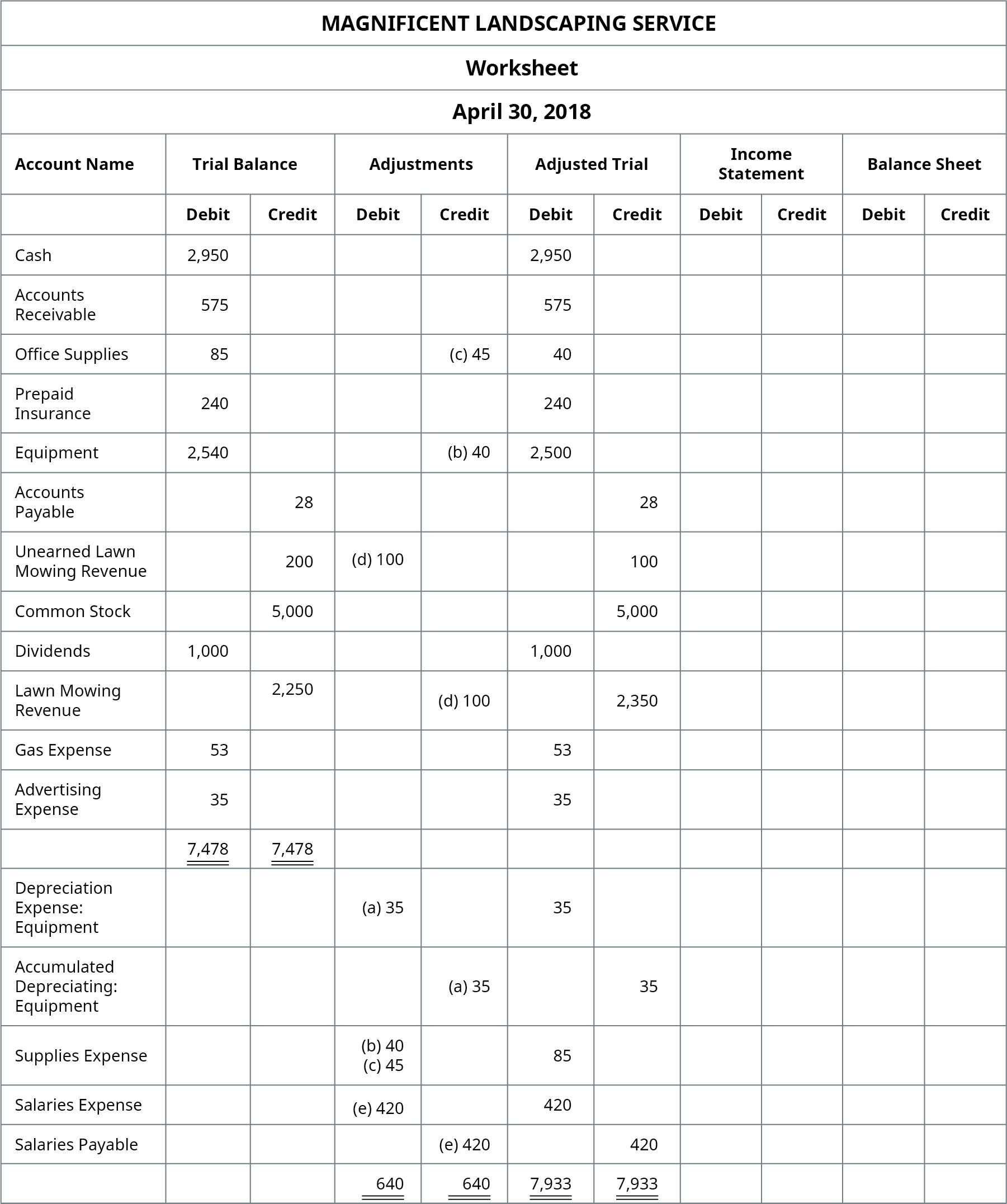

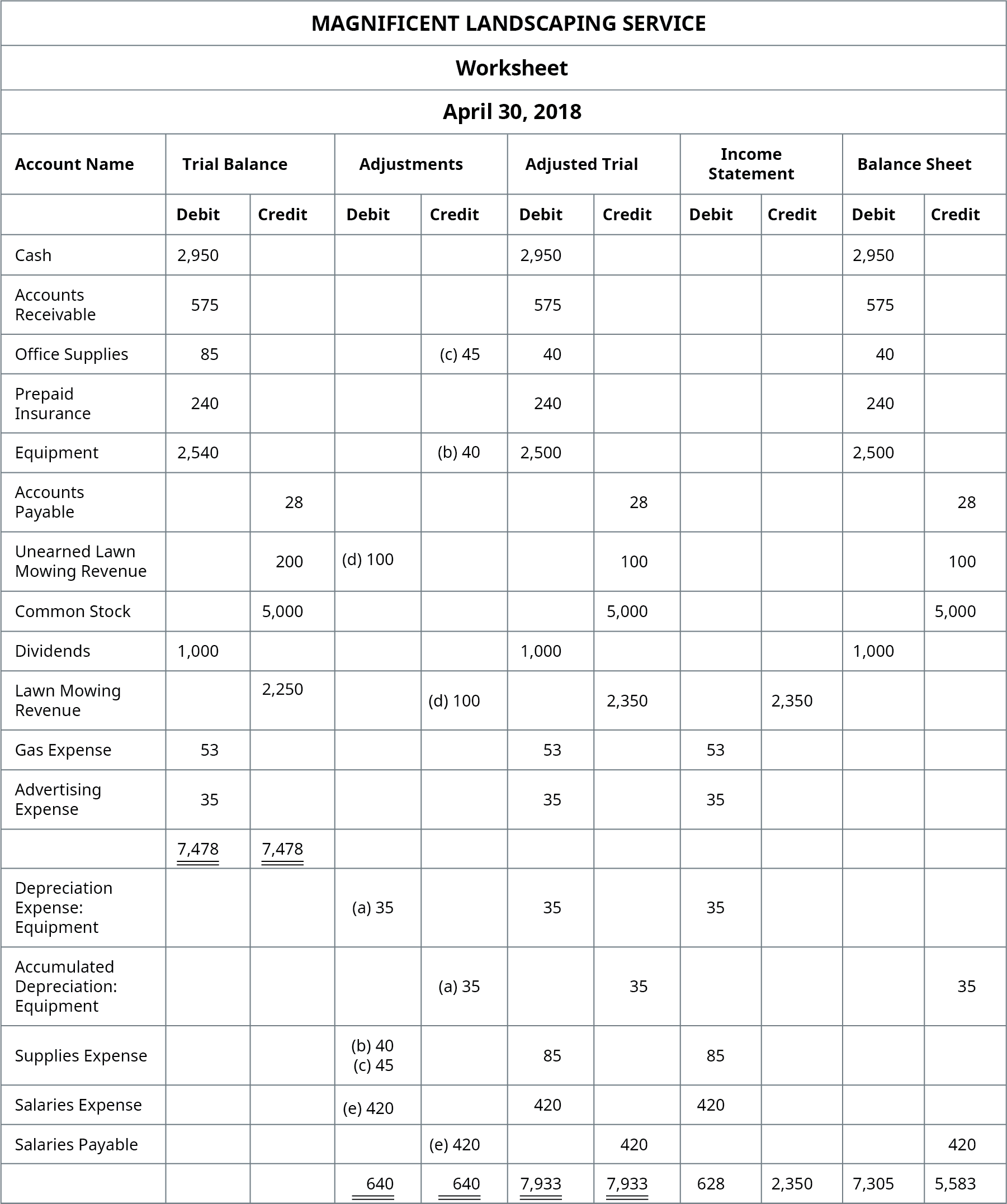

Magnificent Well-balanced Trial Balance

Go ended the adjusted trial balance for Magnificent Landscaping Service. Identify which statement each account will go connected: Balance Sheet, Command of Retained Earnings, or Income Statement.

Solution

Balance Sheet: Cash, accounts receivable, government agency supplied, postpaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries account payable, honorary lawn mowing receipts, and common stock. Statement of Retained Earnings: Dividends. Income Statement: Lawn mowing tax revenue, boast disbursement, advertizing expense, depreciation disbursal (equipment), supplies expense, and salaries expense.

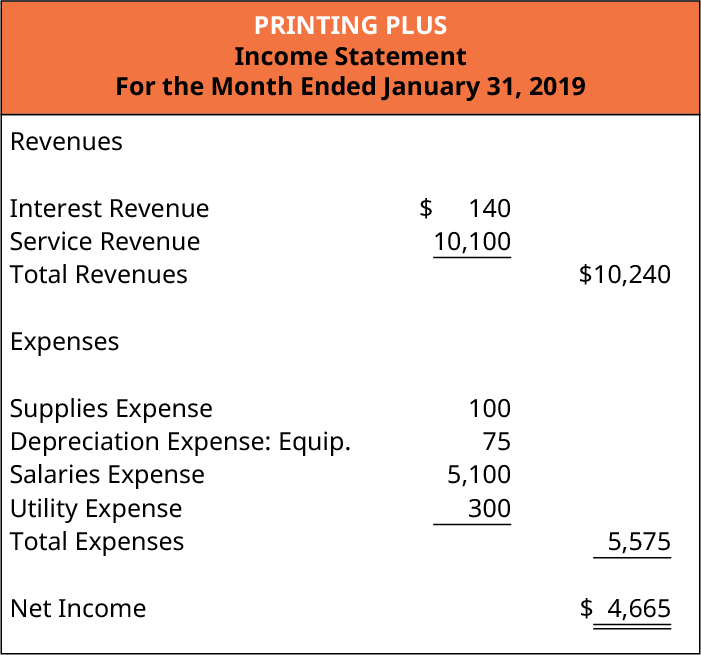

Income Command

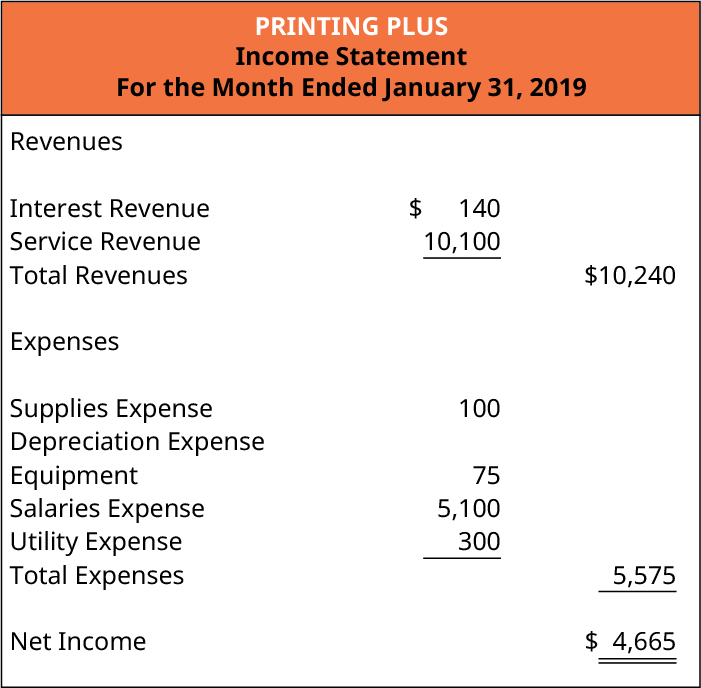

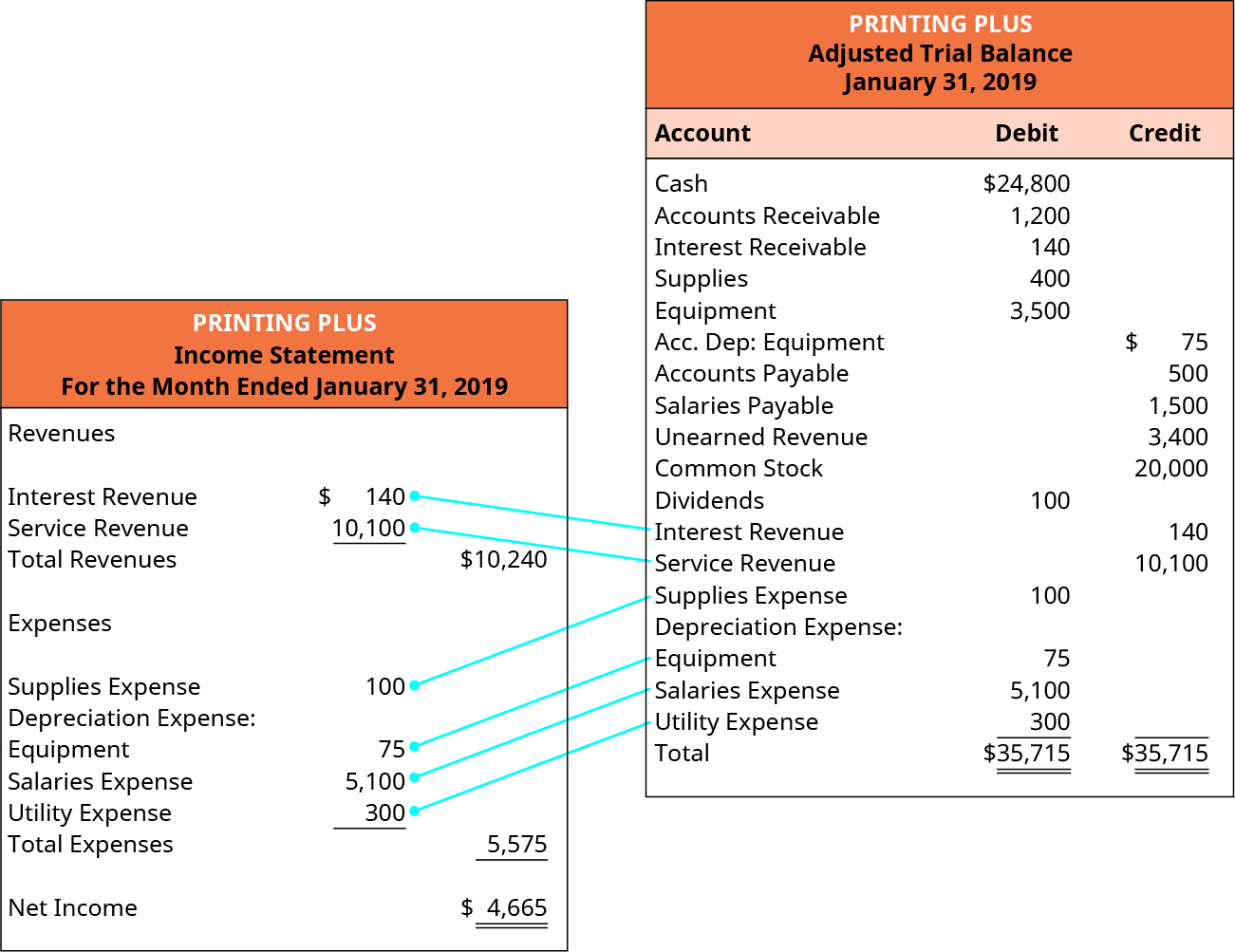

An income statement shows the organization's financial performance for a given period. When preparing an income command, revenues wish always number earlier expenses in the presentation. For Printing Plus, the undermentioned is its January 2019 Income Statement.

Revenue and disbursal information is condemned from the keyed trial balance as follows:

Total revenues are $10,240, while total expenses are $5,575. Total expenses are subtracted from total revenues to get under one's skin a lucre income of $4,665. If total expenses were much than total revenues, Printing Plus would have a net loss rather than a net income. This net anatomy is used to get up the statement of preserved profit.

The Importance of Accurate Commercial enterprise Statements

Financial statements give a glimpse into the operations of a company, and investors, lenders, owners, and others depend on the accuracy of this data when qualification future investing, lending, and growth decisions. When ane of these statements is inaccurate, the financial implications are great.

For example, Celadon Group misreported revenues over the yoke of trine old age and elevated earnings during those years. The total overreported income was approximately $200–$250 million. This gross misreporting misled investors and led to the remotion of Celadon Group from the New York Breed Commute. Non only did this negatively touch on Celadon Group's stock price and lead to guilty investigations, but investors and lenders were left field to wonder what might happen to their investment funds.

That is why IT is so important to start through the elaborate accounting treat to reduce errors early on and hopefully prevent misinformation from reach commercial enterprise statements. The business must have strong internal controls and better practices to secure the information is presented fair.1

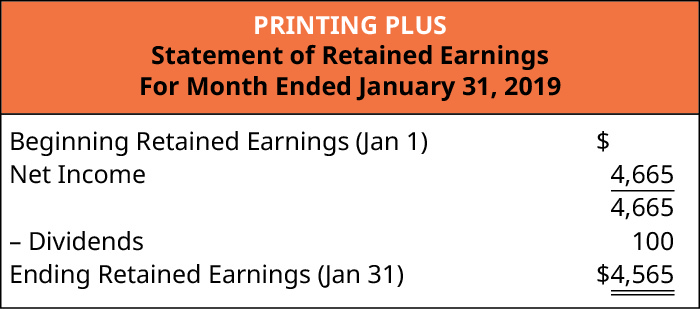

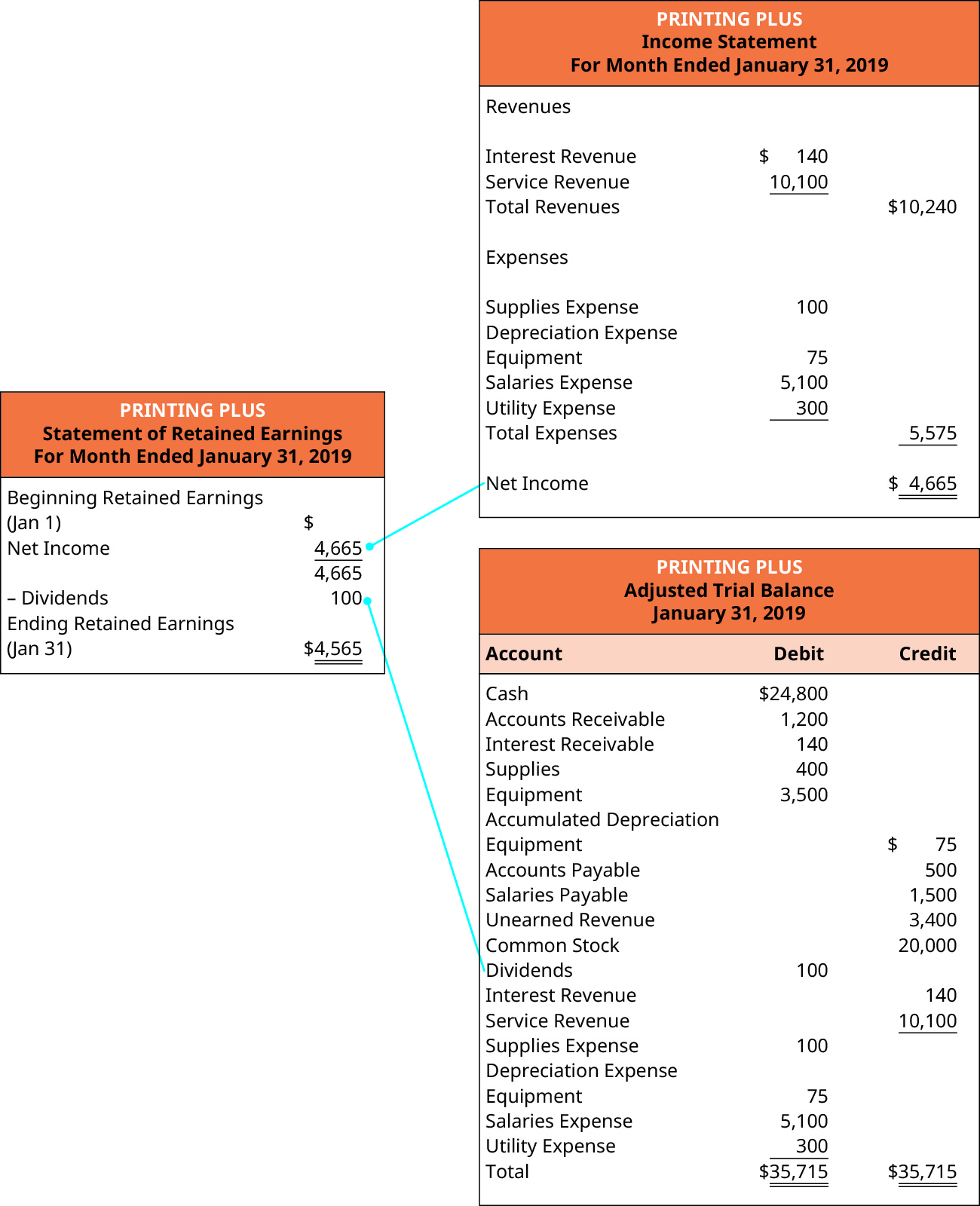

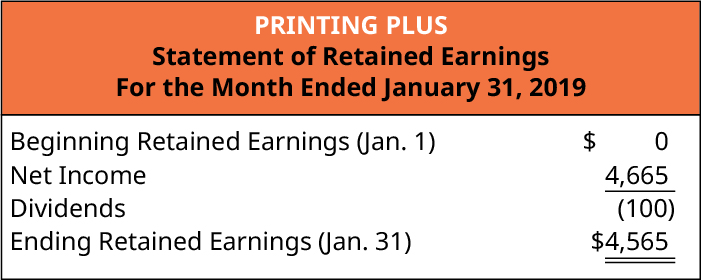

Statement of Retained Earnings

The assertion of retained earnings (which is often a component of the command of stockholders' fairness) shows how the equity (or value) of the organization has changed over a period of time. The statement of maintained earnings is prepared second to determine the ending retained earnings proportionality for the period. The statement of retained earnings is prepared before the correspondence sheet because the ending retained earnings amount is a required factor of the balance sheet. The following is the Statement of Maintained Earnings for Printing Plus.

Nett income information is taken from the income statement, and dividends information is taken from the adjusted visitation balance atomic number 3 follows.

The affirmation of retained earnings e'er leads with opening retained earnings. Beginning preserved earnings carry over from the previous period's ending retained salary balance. Since this is the first month of business for Printing Plus, thither is no beginning retained earnings balance. Notice the sack income of $4,665 from the profit-and-loss statement is carried over to the financial statement of preserved earnings. Dividends are understood out from the sum of root retained earnings and net income to get the ending retained earnings balance of $4,565 for January. This closing retained earnings balance is transferred to the balance sheet.

Concepts Statements give the Financial Accounting Standards Board (FASB) a guide to creating accounting principles and consider the limitations of financial statement reporting. See the FASB's "Concepts Statements" Thomas Nelson Page to learn more.

Counterpoise Sheet

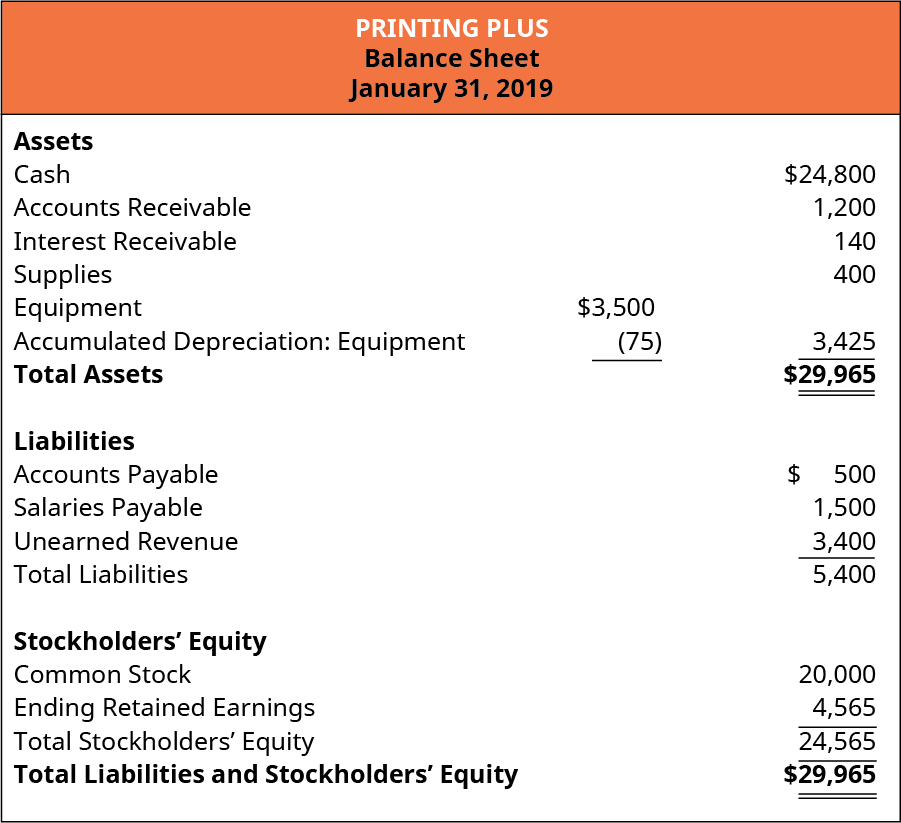

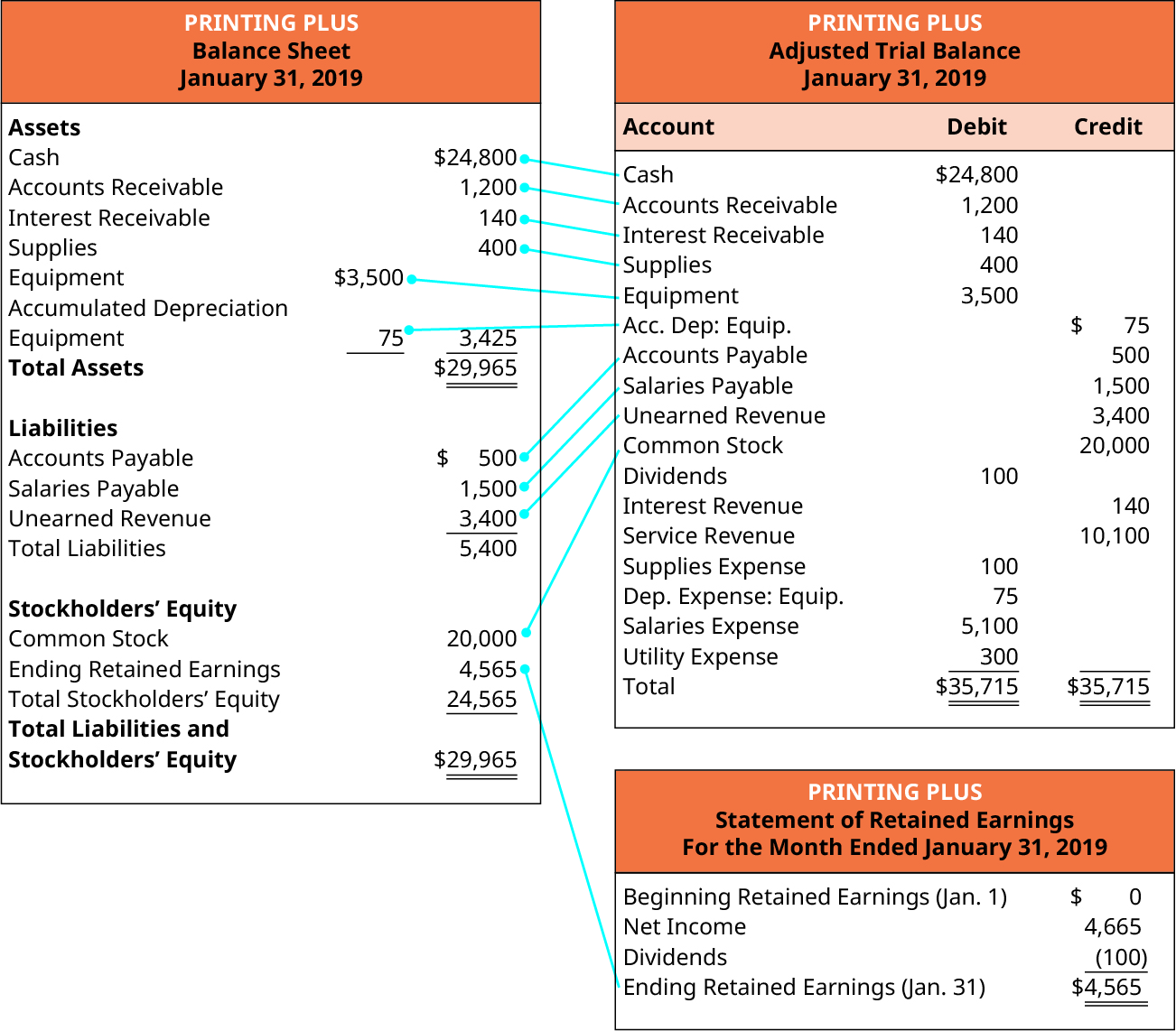

The balance sheet is the third statement prepared after the statement of preserved earnings and lists what the organization owns (assets), what it owes (liabilities), and what the shareholders control (equity) on a specific date. Remember that the balance sheet represents the accounting equation, where assets isochronal liabilities plus stockholders' equity. The pursuit is the Balance Sheet for Printing Addition.

Ending retained earnings information is taken from the statement of retained earnings, and asset, liability, and democratic stock information is taken from the adjusted run balance A follows.

Look the plus section of the balance sheet, Increased Depreciation–Equipment is included as a contra asset news report to equipment. The accumulated depreciation ($75) is taken away from the original cost of the equipment ($3,500) to show the script value of equipment ($3,425). The accounting equation is harmonious, as shown on the balance sheet, because tote up assets equal $29,965 as do the total liabilities and stockholders' equity.

At that place is a worksheet approach a party may use to make sure end-of-period adjustments interpret to the correct financial statements.

Fiscal Statements

Both US-based companies and those headquartered in other countries produce the same of import business statements—Income Statement, Balance Sheet, and Argument of Hard cash Flows. The presentation of these three primary financial statements is largely similar with respect to what should be reported subordinate US GAAP and IFRS, only some intriguing differences bum arise, particularly when presenting the Balance Sheet.

Spell some US Generally accepted accounting practices and IFRS require the same stripped elements that mustiness be rumored along the Operating statement, such as revenues, expenses, taxes, and earning, to public figure a couple of, in public listed companies in the United States have further requirements placed by the SEC on the reporting of financial statements. For example, IFRS-based financial statements are only required to report the current period of information and the info for the prior period. US GAAP has no necessity for reporting prior periods, but the SEC requires that companies pose one prior historical period for the Balance Sheet and three prior periods for the Profit-and-loss statement. Under both IFRS and USA GAAP, companies can report more than the minimum requirements.

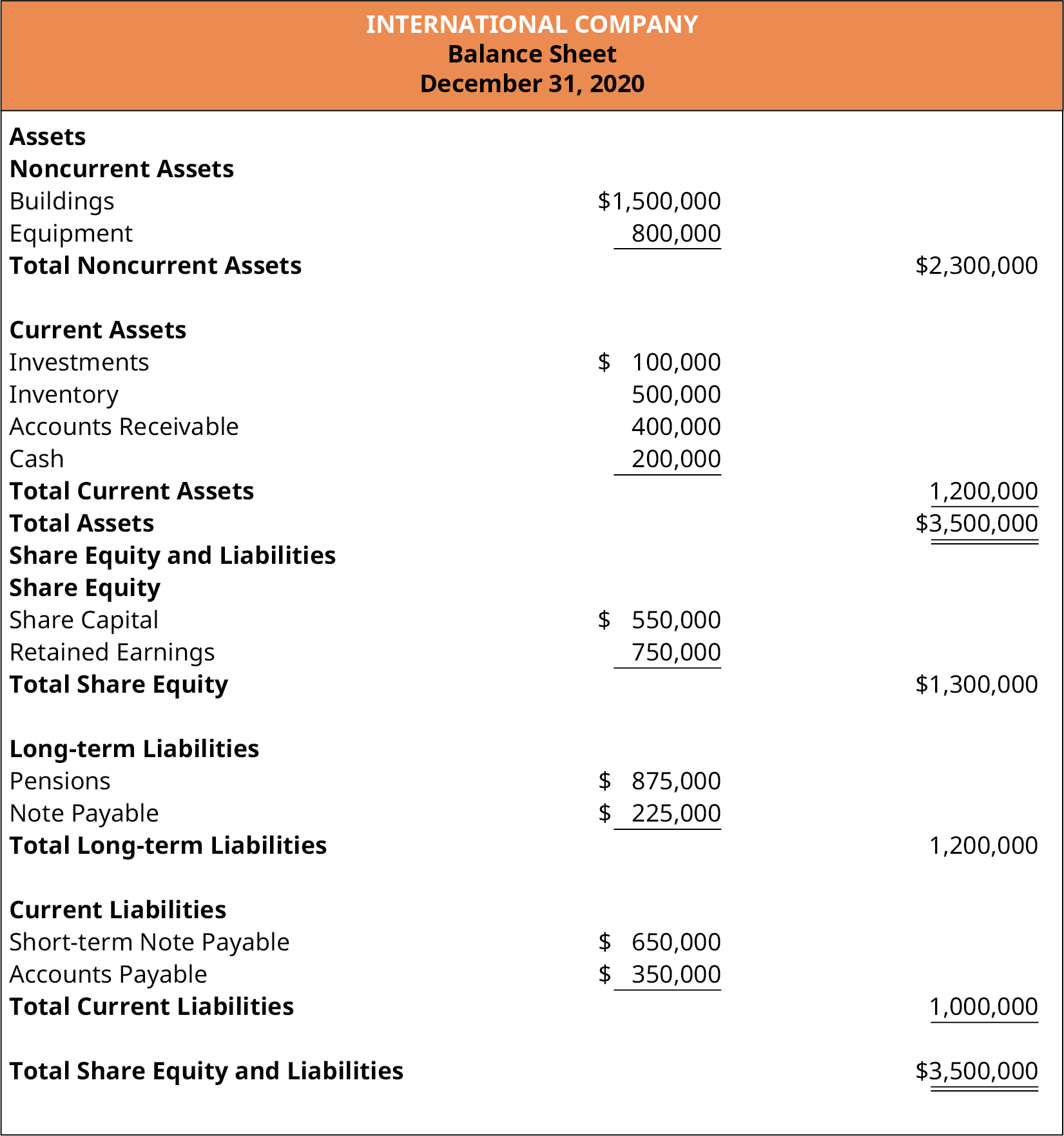

Presentation differences are most evident between the two forms of GAAP in the Balance Sheet. Under US GAAP thither is zero specialised requirement on how accounts should be presented. However, the SEC requires that companies present their Balance Sheet information in fluidity order, which means on-going assets listed first with cash being the showtime account presented, as IT is a company's most liquid account. Liquidity refers to how easy an item tin can be converted to cash. IFRS requires that accounts be classified into current and old categories for both assets and liabilities, merely no particular presentation format is required. Thus, for US companies, the first class always seen on a Balance Weather sheet is Prevailing Assets, and the first account balance reported is Cash. This is not always the case under IFRS. While umteen Libra the Balance Sheets of international companies bequeath live presented in the same manner as those of a United States of America companion, the lack of a required format substance that a society can present noncurrent assets prototypal, followed by current assets. The accounts of a Balance Sheet using IFRS mightiness appear as shown Hera.

Revue the annual cover of Stora Enso which is an international troupe that utilizes the illustrated format in presenting its Balance Sheet, also called the Statement of Financial Position. The Balance Sheet is found on page 31 of the write up.

Some of the biggest differences that pass off on financial statements prepared under US GAAP versus IFRS connect primarily to mensuration or timing issues: in other language, how a transaction is valued and when it is recorded.

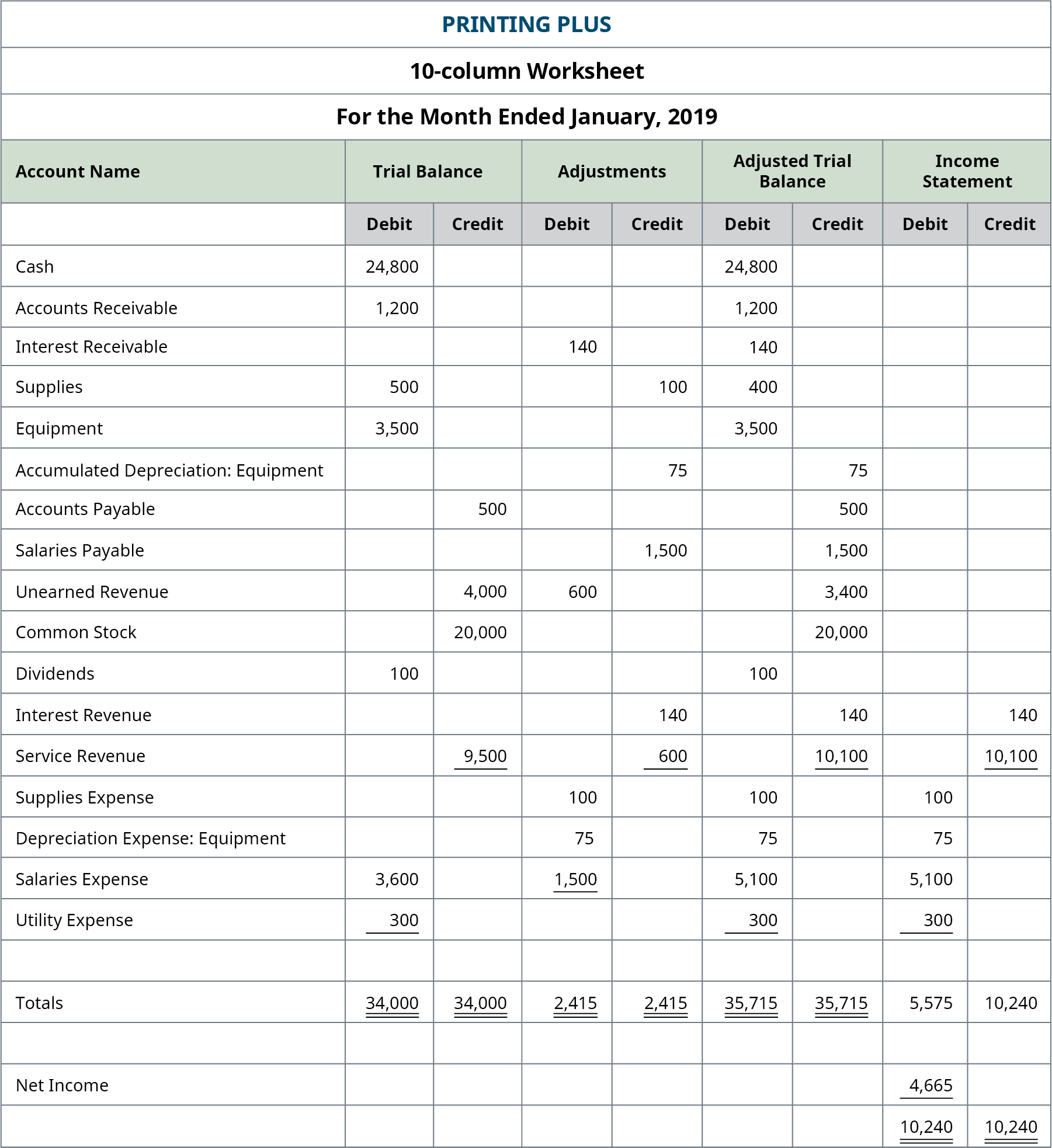

Cardinal-Column Worksheets

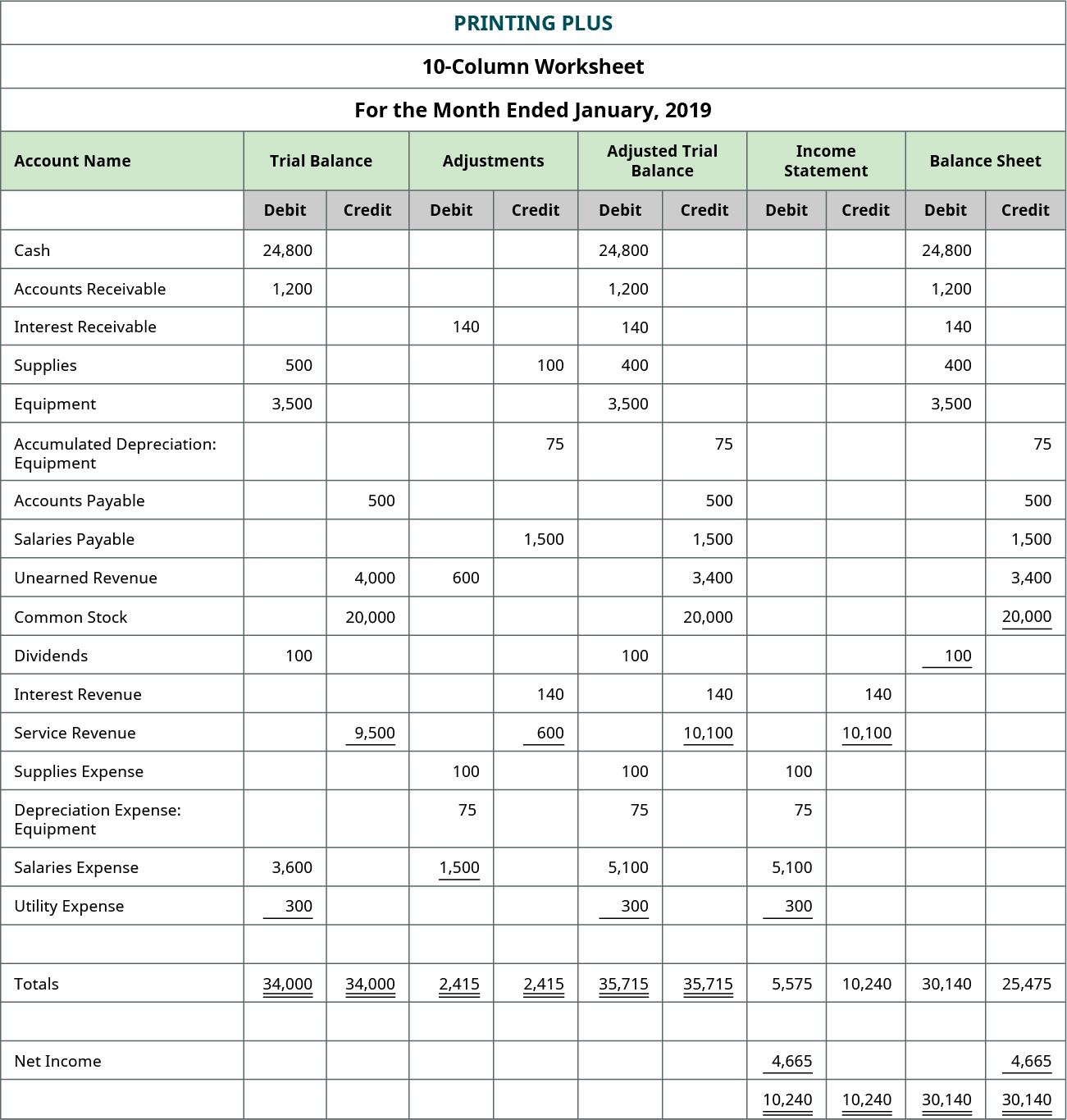

The 10-column worksheet is an completely-in-unmatchable spreadsheet display the transition of account information from the trial equalise through the fiscal statements. Accountants use the 10-column worksheet to help oneself calculate end-of-period adjustments. Using a 10-column worksheet is an optional step companies may use in their accounting process.

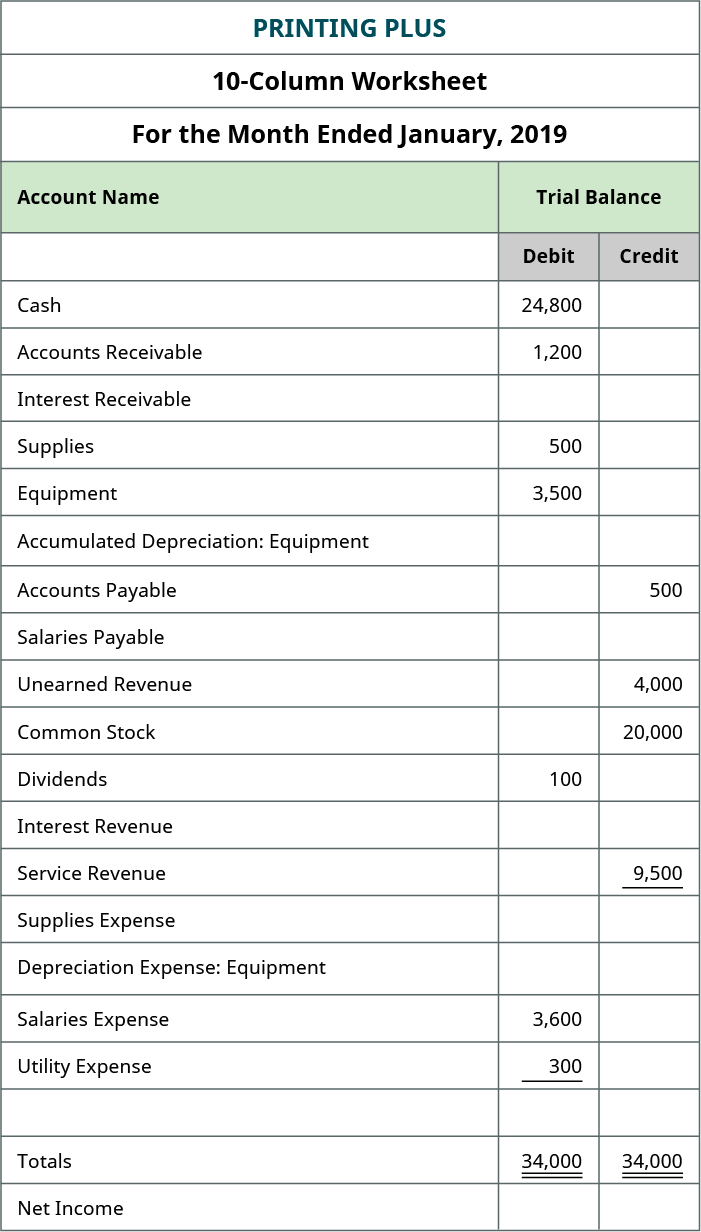

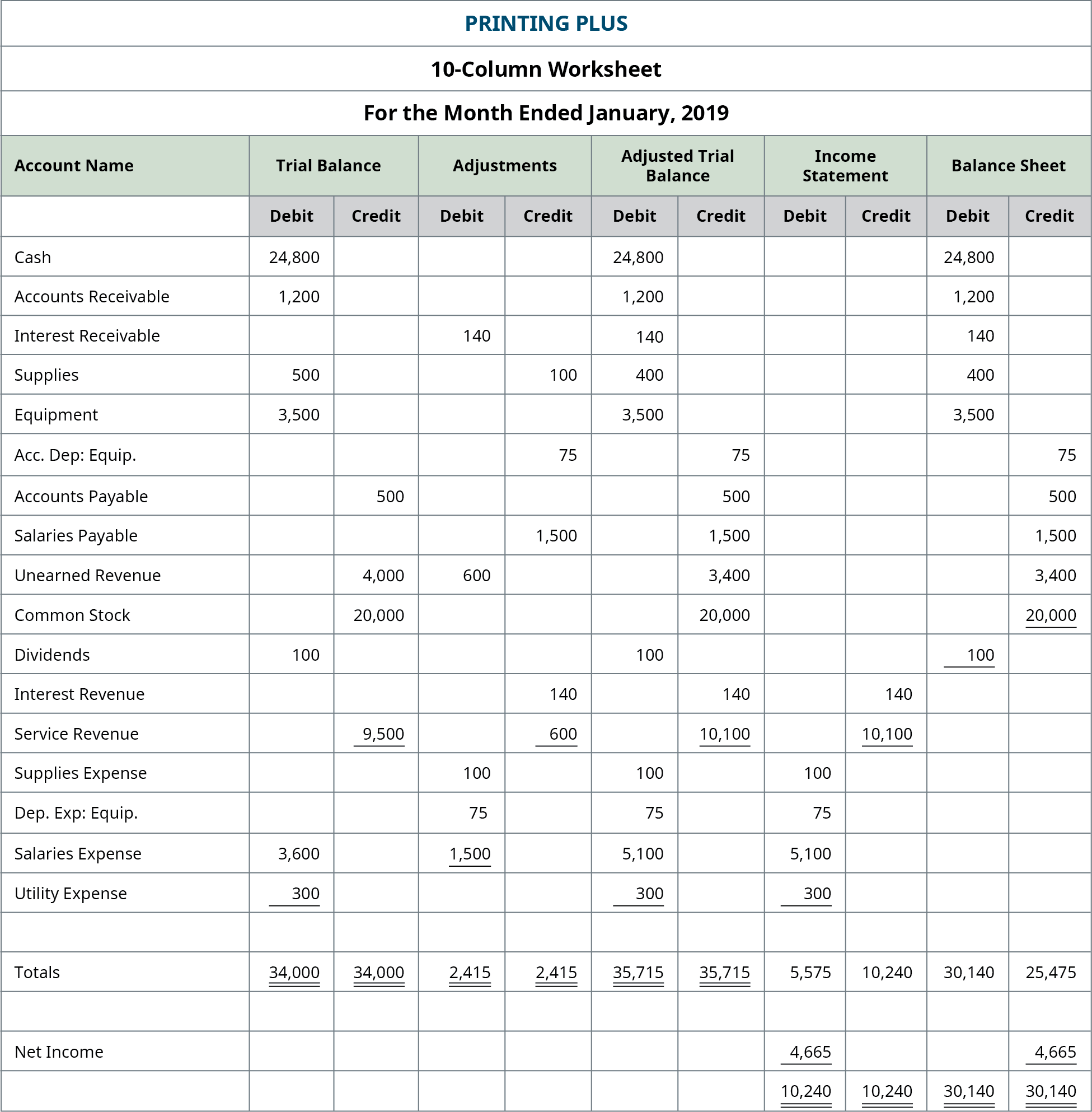

Here is a picture of a 10-tower worksheet for Printing Plus.

There are five sets of columns, each place having a column for debit and credit, for a total of 10 columns. The five column sets are the trial balance, adjustments, adjusted tryout balance, operating statement, and the Libra the Balance sheet. After a company posts its day-to-day journal entries, it can begin transferring that information to the trial balance columns of the 10-tower worksheet.

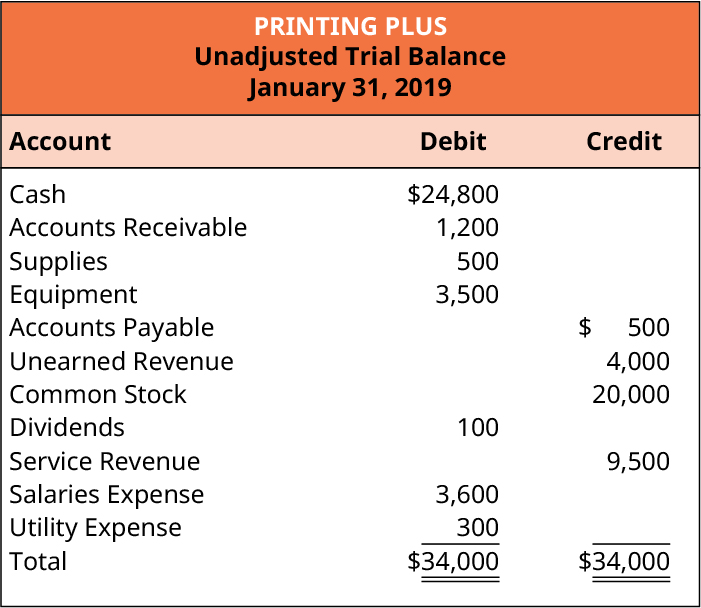

The trial balance info for Printing Plus is shown antecedently. Discover that the debit and credit columns both equal $34,000. If we go back and deal the trial balance for Printing Plus, we get wind that the trial equilibrate shows debits and credits equal to $34,000.

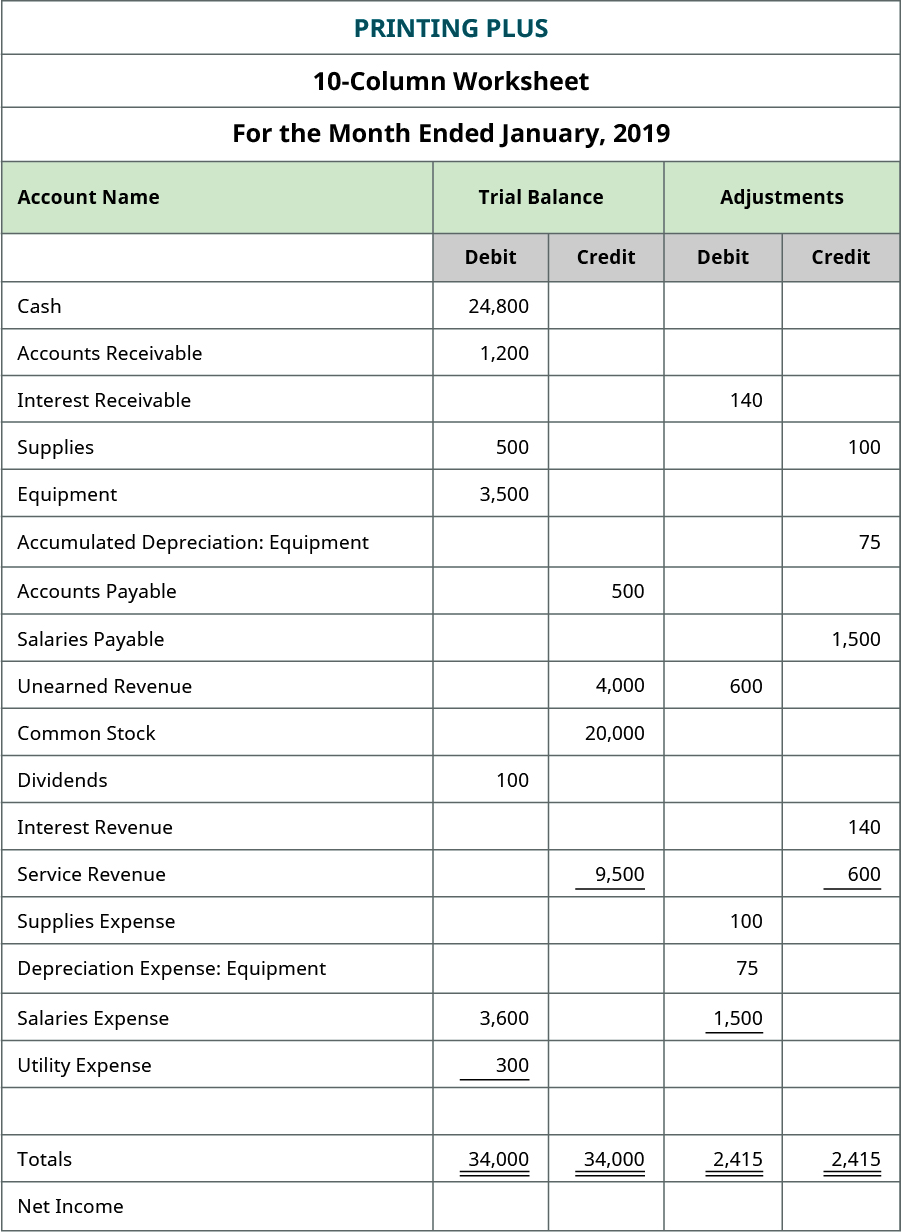

Once the trial balance information is happening the worksheet, the next step is to fill out the adjusting information from the posted adjusted diary entries.

The adjustments tot of $2,415 balances in the debit and credit columns.

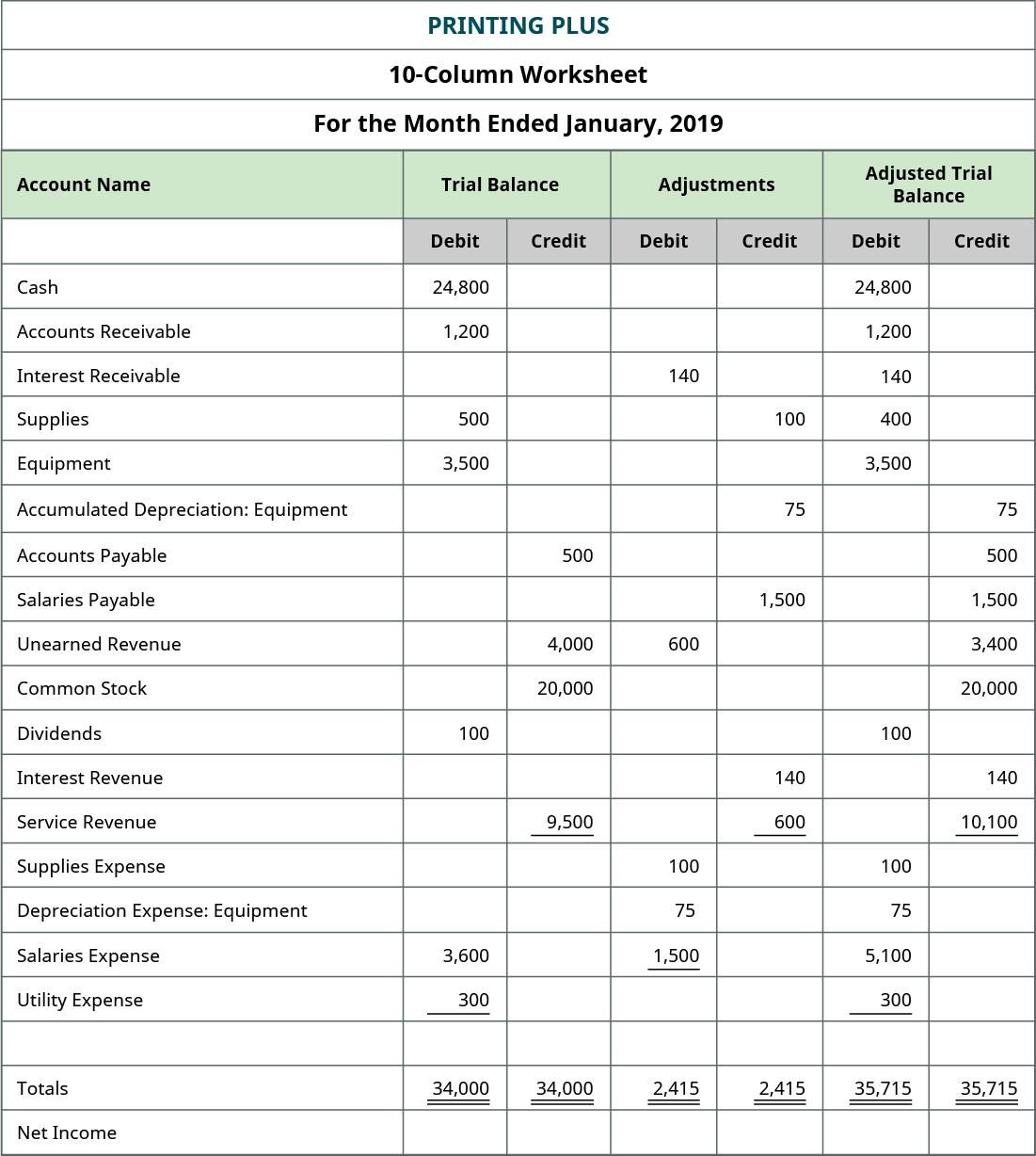

The next tone is to record information in the adjusted trial residuum columns.

To get the numbers in these columns, you subscribe to the number in the trial equilibrise column and add or subtract any number found in the adjustment column. For deterrent example, Cash shows an unadjusted equalise of $24,800. Thither is no fitting in the adjustment columns, so the Cash counterpoise from the unadjusted balance column is transferred over to the adjusted trial balance columns at $24,800. Interest Receivable did not exist in the trial balance data, thus the equalizer in the adjustment column of $140 is transferred over to the adjusted trial balance tower.

Unearned revenue had a credit balance of $4,000 in the trial balance chromatography column, and a debit entry adjustment of $600 in the adjustment column. Remember that adding debits and credits is like adding affirmative and negative numbers. This means the $600 debit is subtracted from the $4,000 recognition to get a credit balance of $3,400 that is translated to the adjusted trial balance newspaper column.

Service Revenue had a $9,500 credit balance in the trial equalise tower, and a $600 credit balance in the Adjustments column. To get the $10,100 credit res in the adjusted trial balance column requires adding together both credits in the trial balance and modification columns (9,500 + 600). You volition do the same process for all accounts. Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are tied. In the case of Printing Plus, the balances even $35,715. If you check the adjusted trial balance for Printing Plus, you wish meet the same isochronous proportion is pose.

Next you will take all of the figures in the adjusted trial balance columns and transmit them over to either the operating statement columns OR the counterpoise sheet columns.

Profit-and-loss statement and Balance Sheet

Take a dyad of minutes and fill in the income statement and balance sheet columns. Absolute them when you are done. Do non panic when they do non balance. They will not proportion at this time.

Answer

Looking at the earnings report columns, we construe with that wholly gross and expense accounts are recorded in either the debit or recognition editorial. This is a reminder that the operating statement itself does non organize data into debits and credits, but we do use this presentation connected a 10-chromatography column worksheet.

You will notice that when debit and citation income program line columns are totaled, the balances are not the same. The debit poise equals $5,575, and the credit Libra equals $10,240. Why do they not counterpoise?

If the debit and credit columns equal each former, information technology means the expenses equal the revenues. This would happen if a company stone-broke even, meaning the company did not hold surgery misplace any money. If there is a difference 'tween the two Book of Numbers, that difference is the amount of net income, or net loss, the company has earned.

In the Printing Plus event, the credit side is the higher figure at $10,240. The citation side represents revenues. This means revenues transcend expenses, thus giving the company a net income. If the debit entry column were larger, this would mean the expenses were large than revenues, leading to a net loss. You deficiency to calculate the net income and get into it onto the worksheet. The $4,665 net income is ground aside taking the accredit of $10,240 and subtracting the debit of $5,575. When entrance net income, it should be written in the column with the lower total. In this illustrate, that would be the debit side. You then sum up the $5,575 and $4,665 to get a total of $10,240. This balances the two columns for the income statement. If you recap the income instruction, you see that net income is in fact $4,665.

We now consider the last two columns for the balance sheet. In these columns we record book all asset, liability, and equity accounts.

When adding the total debits and credits, you mark they do not balance. The debit column equals $30,140, and the credit column equals $25,475. How do we get the columns to balance?

Treat the income statement and balance sheet columns like a double-accounting entry method of accounting, where if you have a debit along the income command side, you must have a credit equaling the same amount along the credit side. In this case we added a debit of $4,665 to the income statement editorial. This agency we must add a cite of $4,665 to the equalise sheet newspaper column. Once we add the $4,665 to the credit side of the balance sheet newspaper column, the ii columns half-and-half $30,140.

You may comment that dividends are included in our 10-newspaper column worksheet balance sheet columns even though this account is not included on a balance canvass. So wherefore is IT included present? There is actually a very good reason we put dividends in the balance sheet columns.

When you prepare a balance sheet, you mustiness first have the most updated retained earnings balance. To get that balance, you guide the origin retained salary balance + earning – dividends. If you look at the worksheet for Printing Addition, you will notice there is no maintained earnings bill. That is because they just started business this month and have no more first retained wage balance.

If you look in the balance sheet columns, we do have the unweathered, up-to-see retained earnings, but it is spread prohibited through two numbers. You have the dividends balance of $100 and net income of $4,665. If you combine these deuce individual numbers ($4,665 – $100), you will have your updated retained earnings Libra the Balance of $4,565, as seen happening the assertion of preserved earnings.

You bequeath non see a similarity between the 10-column worksheet and the balance sheet, because the 10-pillar worksheet is categorizing all accounts aside the character of balance they have, debit operating theatre credit. This leads to a final counterbalance of $30,140.

The balance sheet is classifying the accounts by typecast of accounts, assets and contra assets, liabilities, and equity. This leads to a final balance of $29,965. Even though they are the same numbers in the accounts, the totals on the worksheet and the totals on the balance sheet will glucinium incompatible because of the different presentation methods.

Publicly traded companies release their financial statements quarterly for yawning viewing by the general public, which can usually be viewed on their websites. One such company is First principle, INC. (brand Google). Have a look at Alphabet's quarter ended March 31, 2018, fiscal statements from the SEC Form 10-Q.

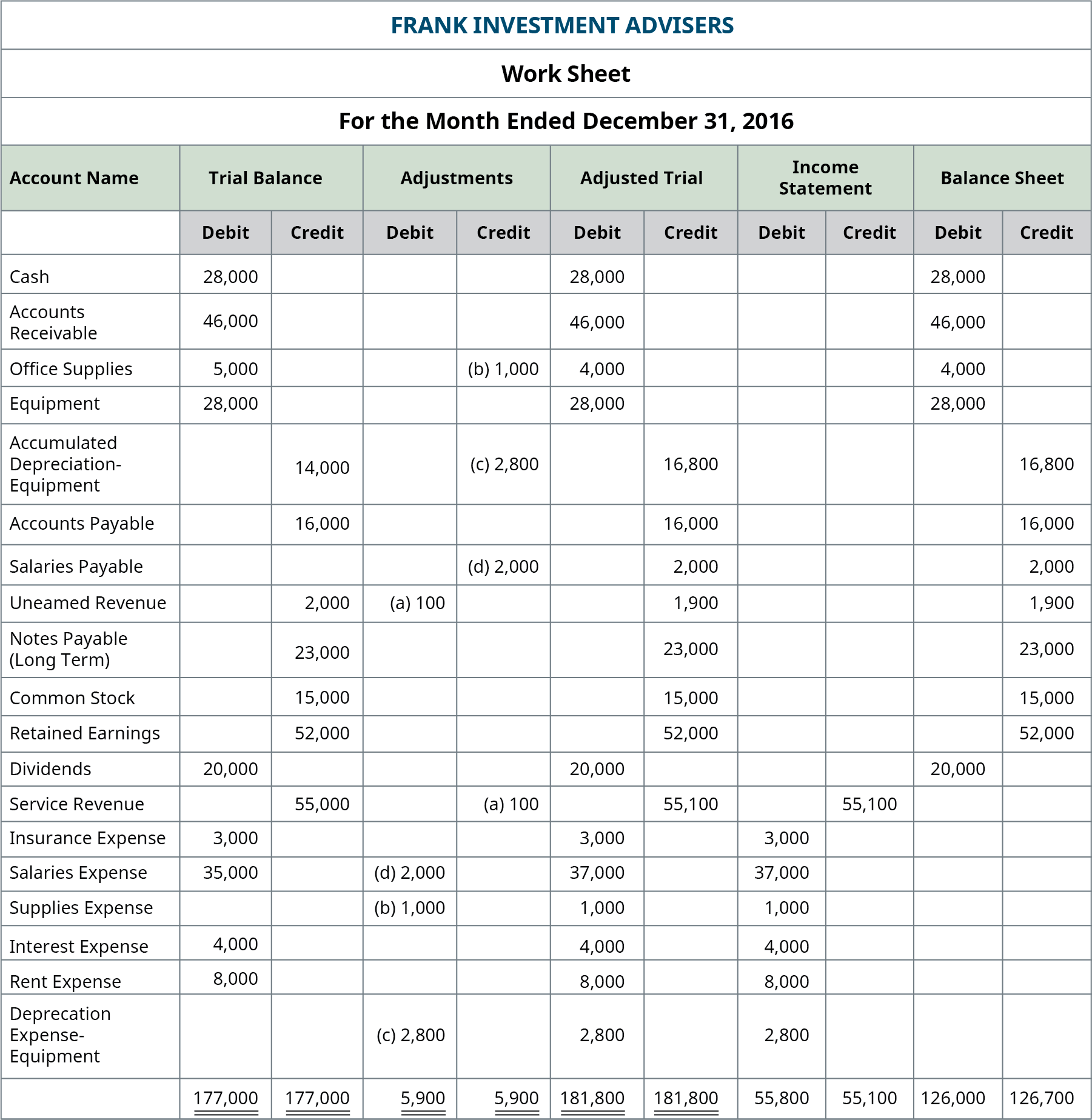

Candid's Net Income and Loss

What amount of net/loss does Frank have?

Solution

In Completing the Accounting Cycle, we continue our discourse of the accounting motorcycle, completing the last steps of journalizing and posting closing entries and preparing a position-terminative trial balance.

Key Concepts and Summary

- Income Statement: The income statement shows the net income or loss as a final result of receipts and expense activities occurring in a period of time.

- Statement of Retained Earnings: The assertion of retained earnings shows the effects of profit (loss) and dividends on the earnings the company maintains.

- Balance Sheet: The equilibrise shrou visually represents the accounting equation, exhibit that assets balance with liabilities and equity.

- 10-column worksheet: The 10-column worksheet organizes data from the trial balance wholly the style through the financial statements.

Multiple Choice

(Figure out)On which statement would the Supplies account appear?

- Balance Sheet

- Operating statement

- Maintained Earnings Statement

- Assertion of Cash Flows

(Figure)On which financial statement would the Dividends business relationship appear?

- Balance Sheet

- Profit-and-loss statement

- Retained Profit Statement

- Statement of Cash Flows

C

(Figure)Connected which statement would the Accumulated Depreciation account appear?

- Counterbalance Sheet

- Income Statement

- Preserved Earnings Statement

- Command of Cash Flows

(Figure)On which two financial statements would the Retained Earnings report appear?

- Balance Sheet

- Income Statement

- Maintained Earnings Assertion

- Statement of Cash Flows

A and C

Questions

(Fancy)Indicate on which financial statement the following accounts (from the altered tryout Libra) would appear: (A) Gross sales Tax income; (B) Unearned Let Revenue; (C) Prepaid Publicizing; (D) Advertizing Expense; (E) Dividends; (F) Cash.

(A) Earnings report; (B) Balance Sheet; (C) Poise Sheet; (D) Income Statement; (E) Retained Earnings Assertion; (F) Symmetry Sheet

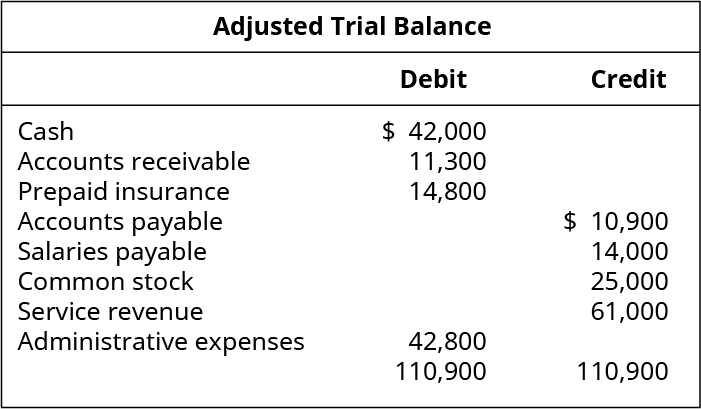

Set A

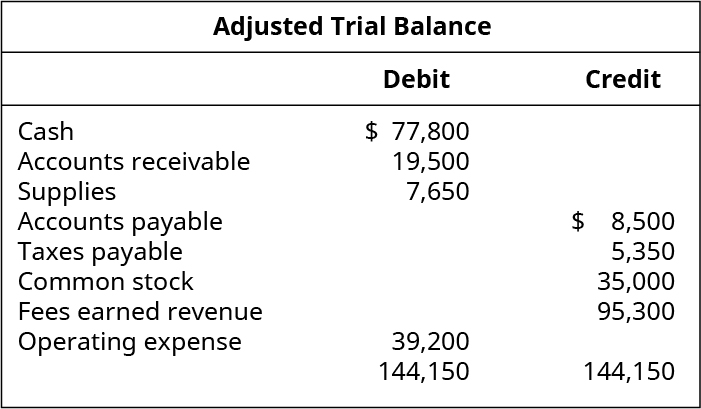

(Figure)From the undermentioned Fellowship A focused trial balance, prepare simple financial statements, as follows:

- Earnings report

- Retained Earnings Assertion

- Balance Sheet

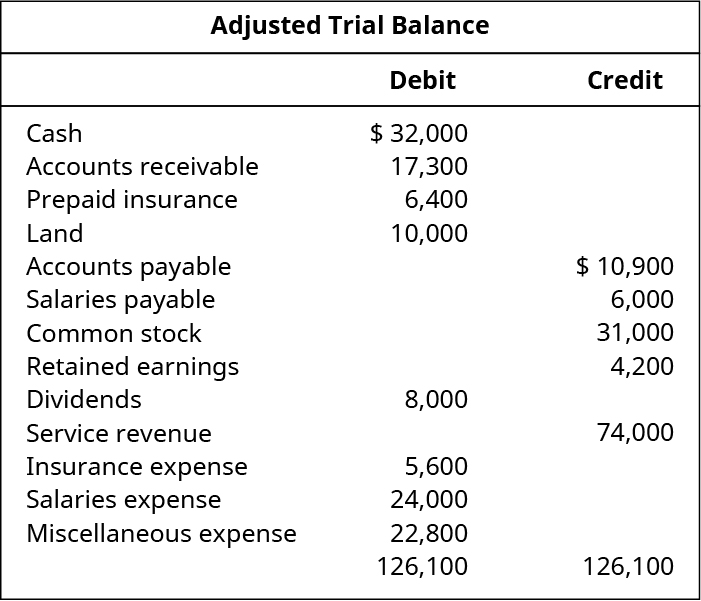

Set B

(Figure)From the following Company B attuned trial balance, prepare elliptic financial statements, As follows:

- Income Statement

- Maintained Earnings Statement

- Counterbalance Sheet

Problem Set A

(Figure)Using the following Company W information, prepare a Preserved Earnings Statement.

- Retained net counterbalance January 1, 2019, $43,500

- Net for class 2019, $55,289

- Dividends declared and paid for yr 2019, $18,000

(Figure)From the succeeding Party Y adjusted tribulation balance, devise simple financial statements, as follows:

- Income Statement

- Retained Earnings Statement

- Balance Canvass

Problem Set B

(Compute)Using the following Company X information, prepare a Maintained Earnings Argument:

- Retained earnings res January 1, 2019, $121,500

- Net income for year 2019, $145,800

- Dividends stated and post-free for year 2019, $53,000

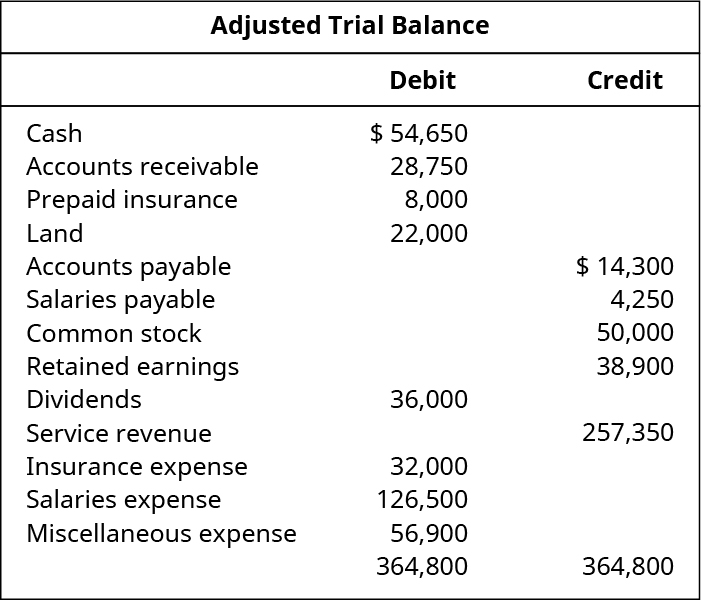

(Trope)From the following Company Z adjusted trial res, prepare simple financial statements, as follows:

- Income Statement

- Retained Earnings Statement

- Balance Sheet

Thought Provokers

(Visualize)Search the Securities and Exchange Commission web site (https://WWW.SEC.gov/Edgar/searchedgar/companysearch.html) and locate the latest Mold 10-K for a company you would corresponding to analyze. Submit a short memo:

- State the name and ticker symbol of the company you have chosen.

- Review the company's end-of-period Balance Sheet, Earnings report, and Program line of Retained Salary.

- Reconstruct an keyed trial proportion for the company, from the information presented in the three specified business enterprise statements.

- Provide the web link to the company's Form 10-K, to allow exact confirmation of your answers.

Footnotes

- 1 James Jaillet. "Celadon subordinate Criminal Investigation over Financial Statements." Commercial Carrier Diary. July 25, 2018. https://www.ccjdigital.com/200520-2/

Glossary

- 10-editorial worksheet

- all-in-one spreadsheet showing the transition of account information from the run equilibrize direct the financial statements

how could a worksheet help in preparing financial statements

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/prepare-financial-statements-using-the-adjusted-trial-balance/

Posting Komentar untuk "how could a worksheet help in preparing financial statements"